Who pays interest on a loan?

Whenever you borrow money, you are required to pay that base amount (the principal) back to your lender. In addition, you will be required to pay your lender the interest, which is typically an annual percentage of the principal, set for the loan.

Interest may be earned by lenders for the use of their funds or paid by borrowers for the use of those funds. Interest is often considered simple interest (based on the principal amount) or compound interest (based on principal and previously-earned interest).

The interest rate is the cost of debt for the borrower and the rate of return for the lender. The money to be repaid is usually more than the borrowed amount since lenders require compensation for the loss of use of the money during the loan period.

The borrower pays only the interest on the loan... until the loan comes due. At that point, the original amount borrowed, or the "principal," is due in full.

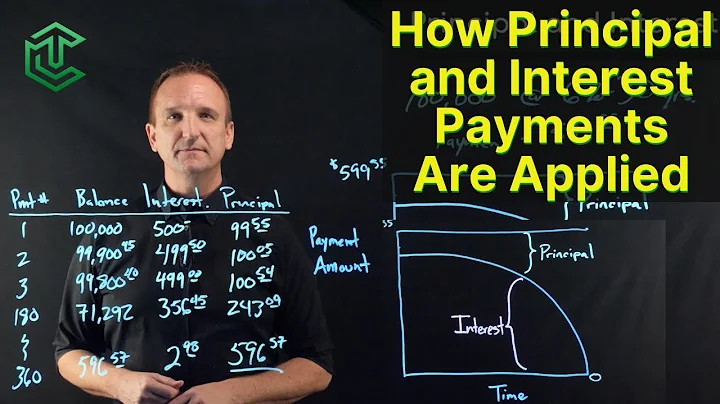

Typically, the total interest due by the end of the loan is broken up into monthly installments. Each payment has an amount allocated to pay a portion of the principal balance owed and an amount allocated to cover the interest due for that month.

Because interest is calculated against the principal balance, paying down the principal in less time on your mortgage reduces the interest you'll pay. Even small additional principal payments can help. Here are a few example scenarios with some estimated results for additional payments.

Bottom line. Sometimes paying interest is inevitable, but there are some steps you can take to avoid these expensive charges. In order to get the best rates and fees — and a lower or 0% APR — you'll need to have a good or excellent credit score.

The risk that borrowers do not repay their loans

For each loan that it makes, a bank will assess the risk that a borrower does not repay their loan (that is, the credit risk). This will influence the revenue the bank expects to receive from a loan and, as a result, the lending rate it charges the borrower.

The lender—usually a corporation, financial institution, or government—advances a sum of money to the borrower. In return, the borrower agrees to a certain set of terms including any finance charges, interest, repayment date, and other conditions.

Which bank gives 7% interest on a savings account? There are not any banks offering 7% interest on a savings account right now. However, two financial institutions are paying at least 7% APY on checking accounts: Landmark Credit Union Premium Checking Account, and OnPath Rewards High-Yield Checking.

Can I pay off a loan early to avoid interest?

Key takeaways. Paying off your loan early can save you hundreds — if not thousands — of dollars worth of interest over the life of the loan. Some lenders may charge a prepayment penalty of up to 2% of the loan's outstanding balance if you decide to pay off your loan ahead of schedule.

Your car payment won't go down if you pay extra, but you'll pay the loan off faster. Paying extra can also save you money on interest depending on how soon you pay the loan off and how high your interest rate is.

Ideally, you want your extra payments to go towards the principal amount. However, many lenders will apply the extra payments to any interest accrued since your last payment and then apply anything left over to the principal amount. Other times, lenders may apply extra funds to next month's payment.

- Setting a Target Date. ...

- Making a Higher Down Payment. ...

- Choosing a Shorter Home Loan Term. ...

- Making Larger or More Frequent Payments. ...

- Spending Less on Other Things. ...

- Increasing Income.

Add extra dollars to every payment

Each month, the extra $200 will pay down your loan's principal and help you pay it off more quickly.

In most cases, you can pay off a personal loan early. Your credit score might drop, but it will typically be minor and temporary. Paying off an installment loan entirely can affect your credit score because of factors like your total debt, credit mix and payment history.

The answer here is, surprisingly, yes. In certain situations, paying off a personal loan early can affect your credit – in both good and bad ways.

There are no legal restrictions to paying off your auto loan early but it may come with fees from your auto loan provider. Paying off a car loan early can be a good option to save money and reduce your debt, but whether it is a good idea depends on your unique financial situation.

A good personal loan interest rate depends on your credit score: 740 and above: Below 8% (look for loans for excellent credit) 670 to 739: Around 14% (look for loans for good credit) 580 to 669: Around 18% (look for loans for fair credit)

| Product | Interest Rate | APR |

|---|---|---|

| 30-Year Fixed Rate | 7.10% | 7.14% |

| 20-Year Fixed Rate | 6.83% | 6.88% |

| 15-Year Fixed Rate | 6.60% | 6.68% |

| 10-Year Fixed Rate | 6.45% | 6.54% |

What are the 3 types of interest?

The three types of interest include simple (regular) interest, accrued interest, and compounding interest.

A slight dip in your score after applying is generally to be expected since a lender will run a hard inquiry on your credit. But using a personal loan to diversify your credit mix and making on time payments toward your balance can have a positive impact on your score.

Does getting a loan build credit? Yes, getting a personal loan can build credit, but only if the lender reports your payments to the credit bureaus. You'll borrow a fixed amount of money from a lender, which you'll then pay back in intervals over the course of the loan term, with interest.

Once you're approved for a personal loan, the cash is usually delivered directly to your checking account. If you're getting a loan to refinance existing debt, you can sometimes request that your lender pay your bills directly.

At a 4.25% annual interest rate, your $100,000 deposit would earn a total of $4,250 in interest over the course of a year if interest compounds annually.

References

- https://homework.study.com/explanation/what-are-four-statements-contained-in-most-annual-reports.html

- https://groww.in/p/tax/rules-of-accounting

- https://www.wallstreetmojo.com/finance-functions/

- https://corporatefinanceinstitute.com/resources/commercial-lending/types-of-interest/

- https://www.silamoney.com/ach/understanding-the-9-major-types-of-financial-institutions

- https://www.investopedia.com/terms/n/networth.asp

- https://www.bfi.co.id/en/blog/jenis-laporan-keuangan-dan-manfaatnya

- https://www.koombea.com/blog/banking-as-a-service/

- https://quizlet.com/za/422493206/01-the-financial-system-flash-cards/

- https://www.suomenpankki.fi/en/financial-stability/the-financial-system-in-brief/

- https://www.cubesoftware.com/blog/4-financial-statements

- https://www.moderntreasury.com/learn/what-is-flow-of-funds

- https://www.mca.gov.in/XBRL/pdf/framework_fin_statements.pdf

- https://www.investopedia.com/terms/c/commercialbank.asp

- https://homework.study.com/explanation/which-of-the-following-are-functions-of-a-financial-system-1-the-operation-of-a-payment-system-2-providing-the-means-of-portfolio-adjustment-3-helping-to-reduce-unemployment-4-channelizing-fu.html

- https://byjus.com/ias-questions/what-are-the-5-most-important-banking-services/

- https://www.investopedia.com/ask/answers/032615/why-do-shareholders-need-financial-statements.asp

- https://www.accountsiq.com/accounting-glossary/what-is-4-4-5-accounting/

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/understanding-income-statements

- https://byjus.com/ias-questions/what-is-the-difference-between-a-financial-institution-and-bank/

- https://abcfinance.co.uk/financial-institution/major-types/

- https://www.iriscrm.com/the-levels-of-banking-in-the-united-states-different-classifications-of-banks-and-what-they-do

- https://www.studysmarter.co.uk/explanations/macroeconomics/financial-sector/financial-system/

- https://homework.study.com/explanation/should-banks-have-to-hold-100-of-their-deposits.html

- https://www.investindia.gov.in/team-india-blogs/10-types-financial-services-offered-india

- https://www.rba.gov.au/education/resources/explainers/banks-funding-costs-and-lending-rates.html

- https://www.cbsnews.com/news/how-much-100000-earns-in-a-high-yield-savings-account/

- https://www.geeksforgeeks.org/top-10-private-banks-in-world/

- https://en.wikipedia.org/wiki/Banking_as_a_service

- https://gocardless.com/en-us/guides/posts/types-of-financial-statements/

- https://www.sofi.com/learn/content/tips-to-pay-off-mortgage-in-5-years/

- https://www.usnews.com/banking/articles/what-types-of-bank-accounts-are-there

- https://study.com/academy/lesson/the-four-basic-functions-of-money.html

- https://www.cnbc.com/select/what-is-a-personal-loan/

- https://www.gob.mx/cms/uploads/attachment/file/525139/FundamentalsFinancialSystem.pdf

- https://www.bankrate.com/mortgages/prepaying-your-mortgage/

- https://www.gpb.org/education/econ-express/financial-institutions

- https://www.lendingtree.com/personal/can-taking-out-a-personal-loan-improve-your-credit/

- https://scf.instructure.com/courses/7298/files/652420/download

- https://www.carboncollective.co/sustainable-investing/preparing-financial-statements

- https://www.bankrate.com/loans/personal-loans/tips-to-pay-off-personal-loans-early/

- https://www.bartleby.com/solution-answer/chapter-1-problem-1mcq-financial-accounting-9th-edition/9781259222139/which-of-the-following-is-not-one-of-the-four-basic-financial-statements-a-balance-sheet-b-audit/3bf5f3c4-b805-11e8-9bb5-0ece094302b6

- https://www.forbes.com/advisor/banking/largest-banks-in-the-us/

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/financial-stability

- https://mmpshahcollege.in/images/pdf/finanServMComII-SemIV.pdf

- https://www.sec.gov/reportspubs/investor-publications/investorpubsbegfinstmtguide

- https://www.bankrate.com/banking/digital-banking-trends-and-statistics/

- https://www.investopedia.com/terms/f/financial-statements.asp

- https://www.investopedia.com/articles/investing/122315/worlds-top-10-banks-jpm-wfc.asp

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/nonbank-financial-institution

- https://www.schwab.com/learn/story/3-financial-statements-to-measure-companys-strength

- https://www.investopedia.com/terms/r/retailbanking.asp

- https://www.investopedia.com/terms/f/financialinstitution.asp

- https://byjus.com/govt-exams/indian-financial-system/

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking---Banks-and-Our-Economy

- https://ca.indeed.com/career-advice/career-development/financial-report-examples

- https://www.orbitanalytics.com/financial-statements/

- https://www.investopedia.com/terms/i/interest.asp

- https://www.businessinsider.com/personal-finance/7-percent-interest-savings-accounts

- https://www.thehindubusinessline.com/money-and-banking/The-seven-lsquoPs-essential-for-marketing-of-bank-services/article20310257.ece

- https://courses.lumenlearning.com/suny-osintrobus/chapter/u-s-financial-institutions/

- https://quizlet.com/15753950/personal-finance-chapter-9-flash-cards/

- https://www.investopedia.com/terms/f/finance.asp

- https://homework.study.com/explanation/in-what-order-are-the-four-primary-financial-statements-statement-of-stockholders-equity-income-statement-balance-sheet-and-statement-of-cash-flows-prepared.html

- https://quizlet.com/192635618/chapter-17-flash-cards/

- https://vskub.ac.in/wp-content/uploads/2020/04/FINANCIAL-SERVICES-6th-Sem.pdf

- https://www.investopedia.com/ask/answers/030315/what-financial-services-sector.asp

- https://quizlet.com/212700443/accounting-unit-1-flash-cards/

- https://www.investopedia.com/ask/answers/061615/what-are-major-categories-financial-institutions-and-what-are-their-primary-roles.asp

- https://www.capitalone.com/learn-grow/money-management/does-paying-off-a-personal-loan-early-hurt-credit/

- https://brainly.com/question/40762881

- https://www.investopedia.com/terms/i/interest-due.asp

- https://www.investopedia.com/terms/f/financial-analysis.asp

- https://en.wikipedia.org/wiki/Financial_services

- https://finance.yahoo.com/personal-finance/does-paying-off-loan-early-hurt-credit-215821501.html

- https://www.investopedia.com/terms/b/bank.asp

- https://www.fool.com/the-ascent/research/largest-mortgage-providers/

- https://www.53.com/content/fifth-third/en/commercial-banking/industries/us-financial-institutions.html

- https://byjus.com/question-answer/what-are-the-disadvantages-of-commercial-banks/

- https://localfirstbank.com/article/four-different-types-of-services-banking/

- https://en.wikipedia.org/wiki/Financial_institution

- https://www.texasgateway.org/resource/133-role-banks

- https://www.masterclass.com/articles/accounting-cycle-guide

- https://www.femaleinvest.com/magazine/ways-to-make-money-investing-in-stocks

- https://en.wikipedia.org/wiki/Non-bank_financial_institution

- https://www.investopedia.com/ask/answers/what-is-finance/

- https://openstax.org/books/principles-financial-accounting/pages/3-3-define-and-describe-the-initial-steps-in-the-accounting-cycle

- https://quizlet.com/253259394/chapter-4-flash-cards/

- https://www.hcltech.com/knowledge-library/what-is-core-banking

- https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Banks

- https://www.cnbc.com/select/how-personal-loans-impact-credit-score/

- https://www.bankrate.com/mortgages/mortgage-rates/

- https://www.investopedia.com/terms/i/interestrate.asp

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking--Banks-Thrifts-and-Credit-Unions

- https://www.bankrate.com/loans/auto-loans/principal-only-payments/

- https://www.investopedia.com/ask/answers/032515/what-are-examples-popular-companies-financial-services-sector.asp

- https://www.bankrate.com/banking/savings/what-is-interest/

- https://www.marketwatch.com/guides/car-loans/pay-off-car-loan-early/

- https://www.cnbc.com/select/avoiding-interest-on-financial-products/

- https://www.fool.com/the-ascent/personal-loans/what-is-good-interest-rate-personal-loan/

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/financial-development

- https://accountingware.com/activreporter/blog/elements-of-a-good-financial-design-statement

- https://www.investopedia.com/ask/answers/030415/what-distinguishes-financial-services-sector-banks.asp

- https://www.investopedia.com/terms/l/loan.asp

- https://nces.ed.gov/pubs2009/fin_acct/chapter5_1.asp

- https://bankmas.co.id/en/blog/kelebihan-menabung-di-bank/

- https://grademiners.com/examples/the-six-core-functions-performed-by-the-financial-system

- https://www.investopedia.com/terms/p/privatebanking.asp

- https://ec.europa.eu/eurostat/statistics-explained/index.php/Glossary:Non-financial_services

- https://www.consumerfinance.gov/ask-cfpb/how-can-i-be-sure-my-money-is-safe-in-my-bank-account-en-1005/

- https://www.jumetfinancial.com/The-Four-Phases-of-Financial-Management.5.htm

- https://stripe.com/guides/introduction-to-banking-as-a-service

- https://www.marketwatch.com/guides/car-loans/car-payoff-calculator/

- https://www.chegg.com/homework-help/questions-and-answers/common-mistakes-made-managing-current-cash-needs-include-lacking-sufficient-liquid-assets--q119221858

- https://www.wellsfargo.com/financial-education/homeownership/loan-amortization-extra-payments/

- https://english.bankingkhabar.com/?p=607

- https://www.bench.co/blog/accounting/net-income-formula

- https://www.chargebee.com/docs/revrec/revrec-445-accounting.html