What are some examples of financial institutions at least 4?

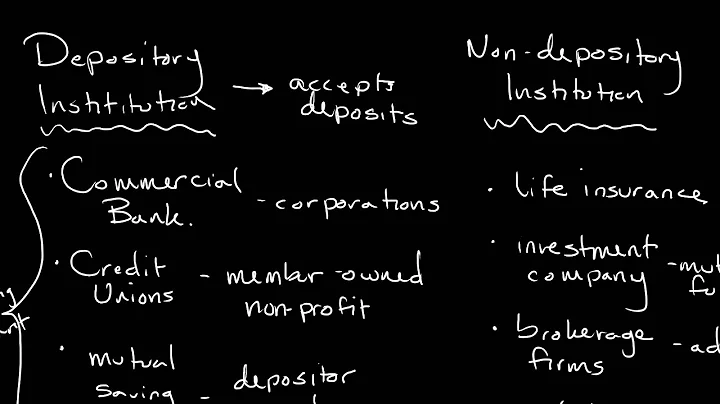

The most common types of financial institutions include banks, credit unions, insurance companies, and investment companies. These entities offer various products and services for individual and commercial clients, such as deposits, loans, investments, and currency exchange.

The most common types of financial institutions include banks, credit unions, insurance companies, and investment companies. These entities offer various products and services for individual and commercial clients, such as deposits, loans, investments, and currency exchange.

They are commercial banks, thrifts (which include savings and loan associations and savings banks) and credit unions. These three types of institutions have become more like each other in recent decades, and their unique identities have become less distinct.

- Checking accounts.

- Savings accounts.

- Debit & credit cards.

- Insurance*

- Wealth management.

Examples of nonbank financial institutions include insurance firms, venture capitalists, currency exchanges, some microloan organizations, and pawn shops. These non-bank financial institutions provide services that are not necessarily suited to banks, serve as competition to banks, and specialize in sectors or groups.

The five key functions of a financial system are: (i) producing information ex ante about possible investments and allocate capital; (ii) monitoring investments and exerting corporate governance after providing finance; (iii) facilitating the trading, diversification, and management of risk; (iv) mobilizing and pooling ...

- Function 1. Clearing and Settling Payments.

- Function 2. Pooling Resources and Subdividing Shares.

- Function 3. Transferring Resources Across Time and Space.

- Function 4: Managing Risk.

- Function 5. Providing Information.

- Function 6. Dealing with Incentive Problems.

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions.

- Central Banks.

- Retail and Commercial Banks.

- Internet Banks.

- Credit Unions.

- Savings and Loan Associations.

- Investment Banks and Companies.

- Brokerage Firms.

- Insurance Companies.

Fifth Third Bank, National Association provides access to investments and investment services through various subsidiaries, including Fifth Third Securities and H2C Securities Inc. co*ker Capital is a division of Fifth Third Securities.

What is the most common financial institution?

Banks are the most common financial institution because they offer the most financial services. Checking accounts, savings accounts, home loans (mortgages), car loans, student loans, investment advice, ATMs, direct deposit and foreign currency swaps are just some of the many services banks offer.

Financial services include accountancy, investment banking, investment management, and personal asset management. Financial products include insurance, credit cards, mortgage loans, and pension funds.

The major categories of financial institutions are central banks, retail and commercial banks, internet banks, credit unions, savings and loan (S&L) associations, investment banks and companies, brokerage firms, insurance companies, and mortgage companies.

Answer and Explanation: The correct answer is - No. Banks do not and should not hold 100% of their deposits since it is beneficial to use the deposits to make loans.

| Ranking | Bank | LEARN MORE |

|---|---|---|

| 1 | JPMorgan Chase | Learn More |

| 2 | Bank of America | Learn More |

| 3 | Wells Fargo | Learn More |

| 4 | Citibank | Learn More |

Whenever you borrow money, you are required to pay that base amount (the principal) back to your lender. In addition, you will be required to pay your lender the interest, which is typically an annual percentage of the principal, set for the loan.

Examples of these include hedge funds, insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations.

Rocket Mortgage, United Shore Financial Services, and loanDepot are the three largest mortgage lenders in the United States -- and all three are non-bank financial institutions. The top three are unchanged from 2021 to 2022.

Final answer: The four institutions that are members of the U.S. banking system are credit unions, savings and loans, commercial banks, and financial investment firms.

Banks, as explained, receive deposits from individuals and businesses and make loans with the money. Savings institutions are also sometimes called savings and loans or thrifts. They also take loans and make deposits.

What are four stages of the financial system?

For individuals and families, we focus on asset/liability matching, tax-efficiency, and cost-effective planning throughout the four key phases of financial management: accumulation, distribution, preservation, and legacy.

The Four Basic Functions of Money

Money serves four basic functions: it is a unit of account, it's a store of value, it is a medium of exchange and finally, it is a standard of deferred payment.

4. Financial Markets. The marketplace where buyers and sellers interact with each other and participate in the trading of money, bonds, shares and other assets is called a financial market.

It breaks down the financial system into its six elements: lenders & borrowers, financial intermediaries, financial instruments, financial markets, money creation and price discovery.

- Capital gains.

- Dividends.

- The magic of compound interest.

References

- https://www.masterclass.com/articles/accounting-cycle-guide

- https://byjus.com/ias-questions/what-are-the-5-most-important-banking-services/

- https://www.cbsnews.com/news/how-much-100000-earns-in-a-high-yield-savings-account/

- https://brainly.com/question/40762881

- https://english.bankingkhabar.com/?p=607

- https://study.com/academy/lesson/the-four-basic-functions-of-money.html

- https://www.cnbc.com/select/how-personal-loans-impact-credit-score/

- https://www.femaleinvest.com/magazine/ways-to-make-money-investing-in-stocks

- https://www.geeksforgeeks.org/top-10-private-banks-in-world/

- https://www.mca.gov.in/XBRL/pdf/framework_fin_statements.pdf

- https://bankmas.co.id/en/blog/kelebihan-menabung-di-bank/

- https://groww.in/p/tax/rules-of-accounting

- https://www.moderntreasury.com/learn/what-is-flow-of-funds

- https://www.investopedia.com/terms/i/interest-due.asp

- https://scf.instructure.com/courses/7298/files/652420/download

- https://www.investopedia.com/terms/i/interestrate.asp

- https://www.koombea.com/blog/banking-as-a-service/

- https://www.investopedia.com/terms/f/finance.asp

- https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Banks

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/understanding-income-statements

- https://www.bankrate.com/banking/savings/what-is-interest/

- https://www.investindia.gov.in/team-india-blogs/10-types-financial-services-offered-india

- https://nces.ed.gov/pubs2009/fin_acct/chapter5_1.asp

- https://www.consumerfinance.gov/ask-cfpb/how-can-i-be-sure-my-money-is-safe-in-my-bank-account-en-1005/

- https://www.investopedia.com/ask/answers/030415/what-distinguishes-financial-services-sector-banks.asp

- https://www.investopedia.com/terms/f/financial-analysis.asp

- https://homework.study.com/explanation/which-of-the-following-are-functions-of-a-financial-system-1-the-operation-of-a-payment-system-2-providing-the-means-of-portfolio-adjustment-3-helping-to-reduce-unemployment-4-channelizing-fu.html

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking---Banks-and-Our-Economy

- https://homework.study.com/explanation/should-banks-have-to-hold-100-of-their-deposits.html

- https://www.investopedia.com/terms/i/interest.asp

- https://www.iriscrm.com/the-levels-of-banking-in-the-united-states-different-classifications-of-banks-and-what-they-do

- https://www.fool.com/the-ascent/personal-loans/what-is-good-interest-rate-personal-loan/

- https://www.cubesoftware.com/blog/4-financial-statements

- https://en.wikipedia.org/wiki/Non-bank_financial_institution

- https://www.investopedia.com/terms/c/commercialbank.asp

- https://www.texasgateway.org/resource/133-role-banks

- https://www.bankrate.com/banking/digital-banking-trends-and-statistics/

- https://www.studysmarter.co.uk/explanations/macroeconomics/financial-sector/financial-system/

- https://www.investopedia.com/terms/b/bank.asp

- https://www.jumetfinancial.com/The-Four-Phases-of-Financial-Management.5.htm

- https://www.chegg.com/homework-help/questions-and-answers/common-mistakes-made-managing-current-cash-needs-include-lacking-sufficient-liquid-assets--q119221858

- https://corporatefinanceinstitute.com/resources/commercial-lending/types-of-interest/

- https://quizlet.com/212700443/accounting-unit-1-flash-cards/

- https://www.thehindubusinessline.com/money-and-banking/The-seven-lsquoPs-essential-for-marketing-of-bank-services/article20310257.ece

- https://quizlet.com/15753950/personal-finance-chapter-9-flash-cards/

- https://www.bankrate.com/mortgages/prepaying-your-mortgage/

- https://byjus.com/ias-questions/what-is-the-difference-between-a-financial-institution-and-bank/

- https://www.sec.gov/reportspubs/investor-publications/investorpubsbegfinstmtguide

- https://www.orbitanalytics.com/financial-statements/

- https://www.wallstreetmojo.com/finance-functions/

- https://www.investopedia.com/terms/f/financial-statements.asp

- https://www.investopedia.com/ask/answers/032615/why-do-shareholders-need-financial-statements.asp

- https://www.marketwatch.com/guides/car-loans/pay-off-car-loan-early/

- https://en.wikipedia.org/wiki/Banking_as_a_service

- https://www.investopedia.com/articles/investing/122315/worlds-top-10-banks-jpm-wfc.asp

- https://courses.lumenlearning.com/suny-osintrobus/chapter/u-s-financial-institutions/

- https://www.cnbc.com/select/avoiding-interest-on-financial-products/

- https://www.bfi.co.id/en/blog/jenis-laporan-keuangan-dan-manfaatnya

- https://www.investopedia.com/terms/p/privatebanking.asp

- https://www.businessinsider.com/personal-finance/7-percent-interest-savings-accounts

- https://homework.study.com/explanation/what-are-four-statements-contained-in-most-annual-reports.html

- https://www.fool.com/the-ascent/research/largest-mortgage-providers/

- https://www.investopedia.com/terms/f/financialinstitution.asp

- https://www.marketwatch.com/guides/car-loans/car-payoff-calculator/

- https://www.investopedia.com/terms/n/networth.asp

- https://byjus.com/question-answer/what-are-the-disadvantages-of-commercial-banks/

- https://www.carboncollective.co/sustainable-investing/preparing-financial-statements

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/nonbank-financial-institution

- https://finance.yahoo.com/personal-finance/does-paying-off-loan-early-hurt-credit-215821501.html

- https://stripe.com/guides/introduction-to-banking-as-a-service

- https://quizlet.com/192635618/chapter-17-flash-cards/

- https://www.gpb.org/education/econ-express/financial-institutions

- https://www.schwab.com/learn/story/3-financial-statements-to-measure-companys-strength

- https://www.lendingtree.com/personal/can-taking-out-a-personal-loan-improve-your-credit/

- https://quizlet.com/za/422493206/01-the-financial-system-flash-cards/

- https://grademiners.com/examples/the-six-core-functions-performed-by-the-financial-system

- https://homework.study.com/explanation/in-what-order-are-the-four-primary-financial-statements-statement-of-stockholders-equity-income-statement-balance-sheet-and-statement-of-cash-flows-prepared.html

- https://www.accountsiq.com/accounting-glossary/what-is-4-4-5-accounting/

- https://www.cnbc.com/select/what-is-a-personal-loan/

- https://www.gob.mx/cms/uploads/attachment/file/525139/FundamentalsFinancialSystem.pdf

- https://www.rba.gov.au/education/resources/explainers/banks-funding-costs-and-lending-rates.html

- https://www.investopedia.com/terms/l/loan.asp

- https://byjus.com/govt-exams/indian-financial-system/

- https://www.bankrate.com/loans/personal-loans/tips-to-pay-off-personal-loans-early/

- https://www.sofi.com/learn/content/tips-to-pay-off-mortgage-in-5-years/

- https://en.wikipedia.org/wiki/Financial_institution

- https://www.53.com/content/fifth-third/en/commercial-banking/industries/us-financial-institutions.html

- https://gocardless.com/en-us/guides/posts/types-of-financial-statements/

- https://www.bankrate.com/mortgages/mortgage-rates/

- https://www.investopedia.com/ask/answers/061615/what-are-major-categories-financial-institutions-and-what-are-their-primary-roles.asp

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking--Banks-Thrifts-and-Credit-Unions

- https://accountingware.com/activreporter/blog/elements-of-a-good-financial-design-statement

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/financial-development

- https://vskub.ac.in/wp-content/uploads/2020/04/FINANCIAL-SERVICES-6th-Sem.pdf

- https://localfirstbank.com/article/four-different-types-of-services-banking/

- https://www.bench.co/blog/accounting/net-income-formula

- https://ca.indeed.com/career-advice/career-development/financial-report-examples

- https://en.wikipedia.org/wiki/Financial_services

- https://www.investopedia.com/ask/answers/what-is-finance/

- https://www.bankrate.com/loans/auto-loans/principal-only-payments/

- https://www.investopedia.com/ask/answers/030315/what-financial-services-sector.asp

- https://quizlet.com/253259394/chapter-4-flash-cards/

- https://www.investopedia.com/ask/answers/032515/what-are-examples-popular-companies-financial-services-sector.asp

- https://www.chargebee.com/docs/revrec/revrec-445-accounting.html

- https://www.wellsfargo.com/financial-education/homeownership/loan-amortization-extra-payments/

- https://www.capitalone.com/learn-grow/money-management/does-paying-off-a-personal-loan-early-hurt-credit/

- https://www.suomenpankki.fi/en/financial-stability/the-financial-system-in-brief/

- https://ec.europa.eu/eurostat/statistics-explained/index.php/Glossary:Non-financial_services

- https://www.forbes.com/advisor/banking/largest-banks-in-the-us/

- https://www.silamoney.com/ach/understanding-the-9-major-types-of-financial-institutions

- https://www.bartleby.com/solution-answer/chapter-1-problem-1mcq-financial-accounting-9th-edition/9781259222139/which-of-the-following-is-not-one-of-the-four-basic-financial-statements-a-balance-sheet-b-audit/3bf5f3c4-b805-11e8-9bb5-0ece094302b6

- https://mmpshahcollege.in/images/pdf/finanServMComII-SemIV.pdf

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/financial-stability

- https://www.hcltech.com/knowledge-library/what-is-core-banking

- https://openstax.org/books/principles-financial-accounting/pages/3-3-define-and-describe-the-initial-steps-in-the-accounting-cycle

- https://www.usnews.com/banking/articles/what-types-of-bank-accounts-are-there

- https://abcfinance.co.uk/financial-institution/major-types/

- https://www.investopedia.com/terms/r/retailbanking.asp